Chase Personal Lending has become a popular choice for individuals seeking financial solutions tailored to their needs. Whether you're consolidating debt, funding home renovations, or managing unexpected expenses, understanding the nuances of personal loans from Chase can make a significant difference in your financial journey. This article dives deep into everything you need to know about Chase Personal Lending, providing expert insights and actionable advice to help you make informed decisions.

Securing a personal loan is no longer a daunting task, thanks to Chase's streamlined lending process. With competitive interest rates, flexible repayment terms, and a user-friendly application process, Chase offers a compelling solution for borrowers. However, it's essential to explore all aspects of Chase Personal Lending to ensure it aligns with your financial goals.

This comprehensive guide aims to equip you with the knowledge and tools necessary to navigate Chase's personal loan offerings effectively. From eligibility criteria to repayment strategies, we'll cover every detail to ensure you're well-prepared to take advantage of this financial opportunity.

Read also:Charlie Sheen Alive Unveiling The Truth Behind The Legend

Table of Contents

- Overview of Chase Personal Lending

- Eligibility Criteria for Chase Personal Loans

- How to Apply for a Chase Personal Loan

- Understanding Chase Personal Loan Interest Rates

- Key Benefits of Chase Personal Lending

- Common Uses for Chase Personal Loans

- Chase Personal Loan Repayment Options

- Comparing Chase Personal Lending with Other Lenders

- Tips for Maximizing Your Chase Personal Loan

- Frequently Asked Questions About Chase Personal Lending

Overview of Chase Personal Lending

Chase Personal Lending provides a straightforward and efficient way for individuals to access the funds they need. As one of the leading financial institutions in the United States, Chase offers personal loans designed to meet a wide range of financial requirements. These loans are unsecured, meaning they do not require collateral, making them an attractive option for many borrowers.

Key Features of Chase Personal Loans:

- Loan amounts ranging from $3,500 to $50,000

- Fixed interest rates, ensuring predictable monthly payments

- Repayment terms spanning 24 to 84 months

- No origination fees or prepayment penalties

Chase's commitment to customer satisfaction is evident in its transparent lending practices and exceptional customer service. By understanding the scope and limitations of Chase Personal Lending, you can determine whether it's the right choice for your financial needs.

Eligibility Criteria for Chase Personal Loans

Income Requirements

To qualify for a Chase personal loan, applicants must meet certain income requirements. Generally, Chase prefers borrowers with a stable income source and a minimum annual income of $24,000. However, this figure may vary depending on individual circumstances and the loan amount requested.

Credit Score Considerations

Chase evaluates applicants' credit scores to assess their creditworthiness. While Chase does not publicly disclose its exact credit score requirements, borrowers with a FICO score of 660 or higher are more likely to be approved. Additionally, a higher credit score can result in more favorable interest rates and terms.

Factors Influencing Credit Score Evaluation:

Read also:Inigo Montoya Portrayed By Unveiling The Iconic Character Behind The Princess Bride

- Credit history

- Debt-to-income ratio

- Payment history

- Existing credit accounts

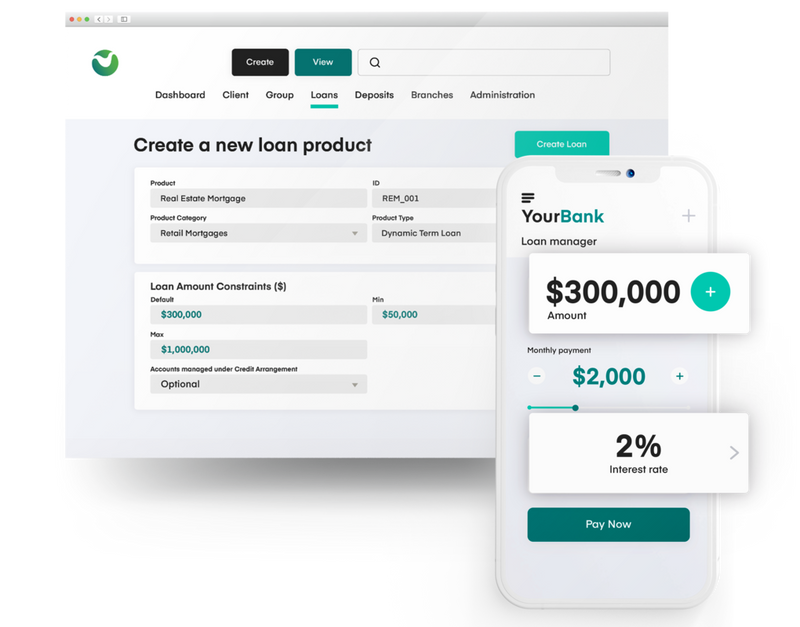

How to Apply for a Chase Personal Loan

The application process for a Chase personal loan is designed to be simple and efficient. Borrowers can apply online or visit a local Chase branch to complete the process. Below is a step-by-step guide to help you navigate the application:

Step 1: Pre-Qualify Online

Before submitting a formal application, you can pre-qualify for a Chase personal loan online. This process allows you to estimate your loan amount and interest rate without affecting your credit score.

Step 2: Gather Required Documents

Having the necessary documentation ready can expedite the application process. Commonly required documents include proof of income, identification, and bank statements.

Step 3: Submit Your Application

Once your documents are in order, you can submit your application online or in person. Chase typically provides a decision within minutes, allowing you to proceed with the loan process swiftly.

Understanding Chase Personal Loan Interest Rates

Interest rates for Chase personal loans vary based on several factors, including credit score, loan amount, and repayment term. As of the latest data, interest rates range from 6.99% to 24.99% APR, depending on the borrower's qualifications.

Tips for Securing Lower Interest Rates:

- Improve your credit score before applying

- Opt for shorter repayment terms

- Consider co-signing with a creditworthy individual

Understanding how interest rates are determined can help you negotiate better terms and reduce the overall cost of borrowing.

Key Benefits of Chase Personal Lending

Chase Personal Lending offers several advantages that set it apart from other lenders. Below are some of the key benefits:

Fixed Interest Rates

With fixed interest rates, borrowers can plan their finances with confidence, knowing that their monthly payments will remain consistent throughout the loan term.

Flexible Repayment Terms

Chase provides repayment terms ranging from 24 to 84 months, allowing borrowers to choose a schedule that suits their financial situation.

No Hidden Fees

Chase does not charge origination fees or prepayment penalties, ensuring transparency and reducing the total cost of borrowing.

Common Uses for Chase Personal Loans

Chase personal loans can be used for a variety of purposes, making them a versatile financial tool. Some of the most common uses include:

Debt Consolidation

Many borrowers use Chase personal loans to consolidate high-interest debt, such as credit card balances, into a single, more manageable payment.

Home Improvements

Funding home renovations or repairs is another popular use for Chase personal loans. With competitive interest rates, borrowers can invest in their properties without breaking the bank.

Unexpected Expenses

From medical bills to car repairs, Chase personal loans provide a safety net for unexpected expenses that may arise.

Chase Personal Loan Repayment Options

Repayment flexibility is a hallmark of Chase Personal Lending. Borrowers can choose from various repayment options to suit their financial needs.

Automatic Payments

Setting up automatic payments can help you avoid late fees and ensure timely repayment. Additionally, Chase often offers discounts for borrowers who enroll in automatic payment plans.

Bi-Weekly Payments

For those who prefer more frequent payments, Chase allows bi-weekly payment schedules, which can help reduce the total interest paid over the loan term.

Comparing Chase Personal Lending with Other Lenders

When evaluating Chase Personal Lending, it's important to compare it with other lenders to ensure you're getting the best deal. Below is a comparison of Chase with some of its competitors:

Interest Rates

Chase's interest rates are competitive but may not always be the lowest available. Borrowers should compare rates from multiple lenders to find the most favorable option.

Loan Limits

Chase offers loan amounts up to $50,000, which is sufficient for most personal loan needs. However, some lenders may offer higher limits for qualified borrowers.

Customer Service

Chase's customer service is widely regarded as exceptional, providing borrowers with peace of mind and support throughout the loan process.

Tips for Maximizing Your Chase Personal Loan

To make the most of your Chase personal loan, consider the following tips:

Plan Your Budget

Before applying for a loan, create a detailed budget to ensure you can comfortably meet your monthly payments.

Monitor Your Credit Score

Regularly checking your credit score can help you maintain a favorable borrowing position and secure better loan terms in the future.

Repay Early if Possible

If your financial situation allows, consider repaying your loan early to save on interest costs. Remember, Chase does not impose prepayment penalties.

Frequently Asked Questions About Chase Personal Lending

What Are the Requirements for a Chase Personal Loan?

To qualify for a Chase personal loan, you must meet income and credit score requirements, have a stable income source, and be a U.S. citizen or resident alien.

How Long Does It Take to Get Approved?

Chase typically provides a decision within minutes after submitting your application. If approved, funds are usually disbursed within a few business days.

Are There Any Fees Associated with Chase Personal Loans?

No, Chase does not charge origination fees or prepayment penalties, ensuring transparency and reducing the total cost of borrowing.

Can I Use a Chase Personal Loan for Any Purpose?

Yes, Chase personal loans can be used for a wide range of purposes, including debt consolidation, home improvements, and unexpected expenses.

Conclusion

Chase Personal Lending offers a reliable and flexible solution for individuals seeking financial assistance. By understanding the eligibility criteria, application process, and repayment options, you can make an informed decision about whether Chase is the right lender for your needs.

We encourage you to take action by exploring Chase's personal loan offerings and comparing them with other lenders. Don't forget to leave a comment or share this article with others who may benefit from the information provided. For more expert financial advice, explore our other articles on personal finance and lending solutions.