Accessing financial resources can be a game-changer for individuals and businesses alike. Among the many options available, a Chase line of credit loan stands out as a flexible and powerful tool to meet various financial needs. Whether you're looking to cover unexpected expenses, consolidate debt, or invest in growth opportunities, understanding how this financial product works is crucial. In this article, we will delve into the intricacies of Chase line of credit loans, offering insights and guidance to help you make informed decisions.

A Chase line of credit loan provides borrowers with a revolving credit line, allowing them to draw funds as needed while only paying interest on the amount used. This feature makes it an attractive option for those seeking financial flexibility. With a wide range of applications, from personal use to business ventures, it's essential to explore the benefits, requirements, and potential drawbacks associated with this type of loan.

In the following sections, we will break down everything you need to know about Chase line of credit loans. From eligibility criteria and application processes to tips for managing your credit line responsibly, this article aims to equip you with the knowledge to navigate this financial product effectively. Let's get started.

Read also:Is Lamont Sanford Still Alive Exploring The Life And Legacy

What Is a Chase Line of Credit Loan?

A Chase line of credit loan is a financial product offered by JPMorgan Chase that provides borrowers with access to a predetermined credit limit. Unlike traditional loans, where you receive a lump sum upfront, a line of credit allows you to withdraw funds as needed. You only pay interest on the amount you use, making it a cost-effective solution for managing cash flow.

Key Features of Chase Line of Credit

- Revolving Credit: Borrowers can repeatedly access funds up to their credit limit.

- Flexible Usage: Funds can be utilized for various purposes, including home improvements, debt consolidation, or business investments.

- Interest on Usage: Interest charges are applied only to the amount of credit used, not the entire credit limit.

- Customizable Terms: Borrowers can choose repayment terms that suit their financial situation.

Understanding these features is essential for maximizing the benefits of a Chase line of credit loan while minimizing potential risks.

Benefits of a Chase Line of Credit Loan

A Chase line of credit loan offers numerous advantages that make it an appealing option for both personal and business borrowers. Below, we explore the key benefits of this financial product.

Financial Flexibility

One of the most significant advantages of a Chase line of credit loan is its flexibility. Borrowers can access funds as needed, allowing them to manage cash flow effectively without being tied to a fixed repayment schedule.

Cost-Effective Borrowing

Since interest is charged only on the amount used, a Chase line of credit loan can be more cost-effective compared to traditional loans. This feature makes it an ideal solution for managing short-term financial needs.

Wide Range of Applications

Whether you're looking to consolidate high-interest debt, finance a home renovation project, or invest in business growth, a Chase line of credit loan can cater to a variety of financial goals.

Read also:Marcia Harvey A Journey Through Fashion Beauty And Influence

Eligibility Criteria for Chase Line of Credit Loan

Before applying for a Chase line of credit loan, it's crucial to understand the eligibility requirements set by the lender. Meeting these criteria increases your chances of approval and helps you secure favorable terms.

Credit Score Requirements

A strong credit score is often a key factor in determining eligibility for a Chase line of credit loan. Generally, borrowers with a credit score of 680 or higher are more likely to qualify for favorable terms. However, Chase may consider applicants with lower scores on a case-by-case basis.

Income Verification

Chase typically requires proof of income to assess your ability to repay the loan. This may include recent pay stubs, tax returns, or bank statements. Demonstrating a stable income source can enhance your application's strength.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio plays a vital role in the approval process. A lower DTI ratio indicates better financial health and increases your likelihood of securing a Chase line of credit loan with competitive terms.

How to Apply for a Chase Line of Credit Loan

Applying for a Chase line of credit loan is a straightforward process. By following these steps, you can increase your chances of a smooth and successful application.

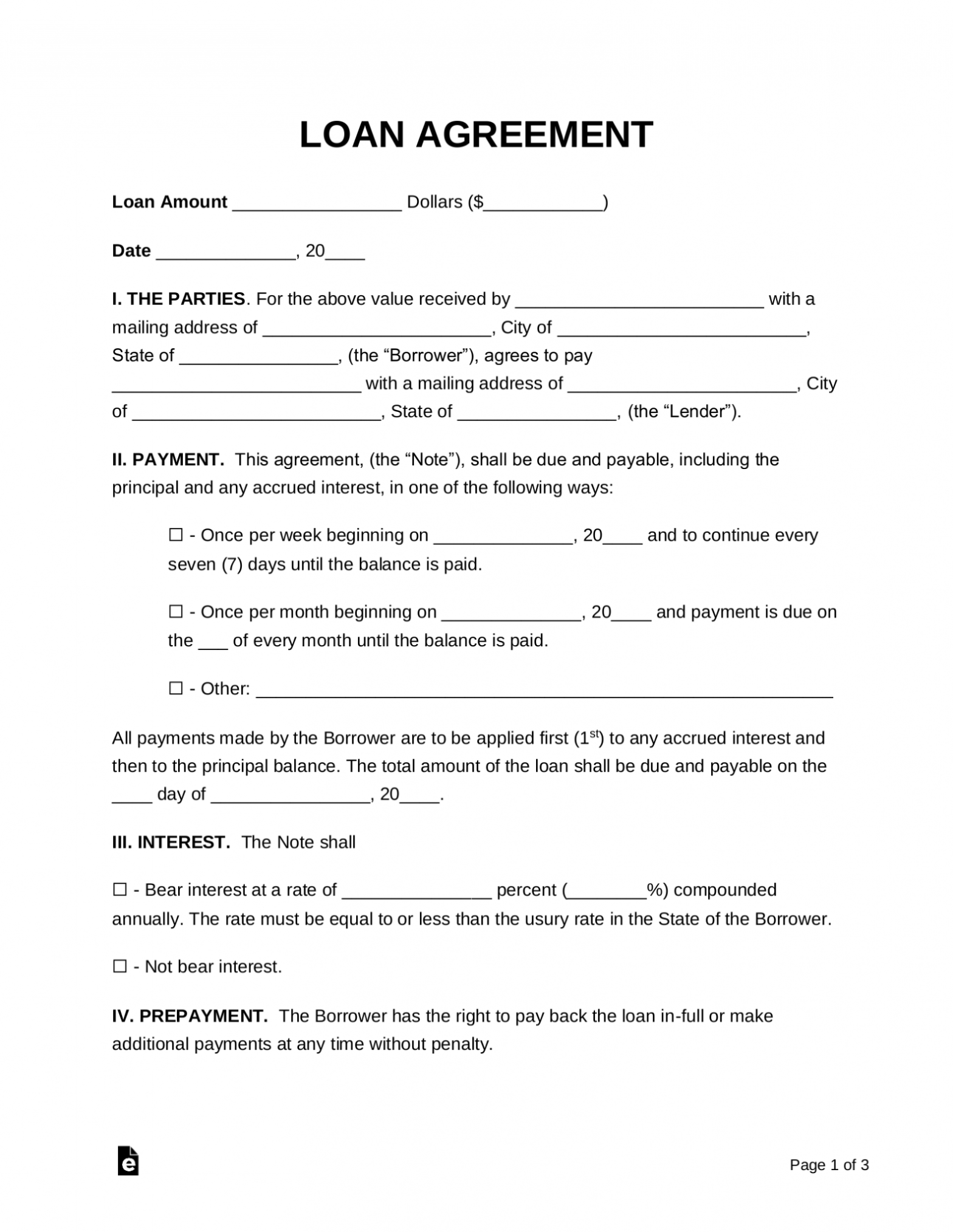

Step 1: Gather Required Documents

Before starting the application process, ensure you have all necessary documents ready. These may include identification proof, income verification, and financial statements.

Step 2: Complete the Application Form

Chase offers both online and in-person application options. Completing the application form accurately and providing all requested information is crucial for a successful submission.

Step 3: Review Terms and Conditions

Once your application is approved, carefully review the terms and conditions of your Chase line of credit loan. Understanding interest rates, repayment schedules, and any associated fees is essential for responsible borrowing.

Managing Your Chase Line of Credit Responsibly

While a Chase line of credit loan offers significant benefits, it's essential to manage it responsibly to avoid potential pitfalls. Below are some tips for responsible credit line management.

Set a Budget

Create a budget that incorporates your line of credit usage and repayment plan. This helps ensure you stay within your financial limits and avoid excessive debt accumulation.

Pay More Than the Minimum

Paying more than the minimum monthly payment reduces interest charges and helps you pay off the balance faster. This practice can save you money in the long run and improve your credit score.

Monitor Your Credit Utilization

Keeping your credit utilization ratio below 30% can positively impact your credit score. Regularly monitoring your credit usage ensures you maintain a healthy financial profile.

Common Questions About Chase Line of Credit Loan

Here are answers to some frequently asked questions about Chase line of credit loans, addressing common concerns and clarifying key points.

What Are the Interest Rates for Chase Line of Credit Loans?

Interest rates for Chase line of credit loans vary based on factors such as credit score, income, and market conditions. Typically, rates range from 7% to 20%, depending on the borrower's financial profile.

Can I Use a Chase Line of Credit for Business Purposes?

Yes, a Chase line of credit loan can be used for business purposes. Many entrepreneurs and small business owners utilize this financial product to fund operations, purchase inventory, or invest in growth opportunities.

Is There an Annual Fee for a Chase Line of Credit?

Chase does not charge an annual fee for its line of credit loans. However, other fees, such as origination fees or late payment penalties, may apply. Reviewing the terms and conditions is essential for understanding all associated costs.

Comparing Chase Line of Credit Loan with Other Financial Products

When evaluating financial options, comparing a Chase line of credit loan with other products can help you make an informed decision. Below, we examine how Chase line of credit loans stack up against alternatives like personal loans and credit cards.

Chase Line of Credit vs. Personal Loan

While both options provide access to funds, a Chase line of credit loan offers greater flexibility due to its revolving nature. Personal loans, on the other hand, typically come with fixed repayment terms and may be more suitable for specific large purchases.

Chase Line of Credit vs. Credit Card

Credit cards and Chase line of credit loans share similarities in terms of revolving credit, but the latter often comes with lower interest rates and higher credit limits, making it a better choice for larger financial needs.

Conclusion

In conclusion, a Chase line of credit loan provides a versatile and cost-effective solution for meeting various financial needs. By understanding its features, benefits, and requirements, you can harness its potential to achieve your financial goals. Remember to manage your credit line responsibly and explore all available options before making a decision.

We invite you to share your thoughts and experiences with Chase line of credit loans in the comments section below. Additionally, feel free to explore other informative articles on our website to enhance your financial knowledge further. Thank you for reading!

Table of Contents

- What Is a Chase Line of Credit Loan?

- Benefits of a Chase Line of Credit Loan

- Eligibility Criteria for Chase Line of Credit Loan

- How to Apply for a Chase Line of Credit Loan

- Managing Your Chase Line of Credit Responsibly

- Common Questions About Chase Line of Credit Loan

- Comparing Chase Line of Credit Loan with Other Financial Products

- Conclusion