BYDDF stock has become one of the most talked-about investment opportunities in the global market today. This stock, representing the American Depository Shares (ADS) of BYD Company Limited, is a beacon for investors looking to tap into the growing electric vehicle (EV) and renewable energy sectors. With its innovative technologies and sustainable practices, BYDDF stock offers a promising avenue for long-term growth and profitability.

In recent years, the demand for clean energy solutions and electric vehicles has surged, positioning BYDDF as a key player in this transformative industry. This article aims to provide an in-depth analysis of BYDDF stock, its performance, and its potential for investors looking to capitalize on the green energy revolution. Whether you're a seasoned investor or just starting your journey, understanding BYDDF stock is crucial for making informed financial decisions.

As we delve into the world of BYDDF, we'll explore its background, market performance, and future prospects. By the end of this article, you'll have a comprehensive understanding of why BYDDF stock is worth considering as part of your investment portfolio. Let's dive in and discover the opportunities this stock presents.

Read also:Why Did Chris Pratt And Anna Faris Divorce Unveiling The Truth Behind Their Split

Table of Contents

- Overview of BYDDF Stock

- Biography of BYD Company

- Market Performance and Trends

- Financial Analysis of BYDDF

- Sustainability and Innovation

- Risks and Challenges

- Long-Term Potential

- Investment Strategy for BYDDF

- Comparison with Competitors

- Conclusion and Call to Action

Overview of BYDDF Stock

BYDDF stock represents the American Depository Shares (ADS) of BYD Company Limited, one of China's leading manufacturers of electric vehicles and renewable energy solutions. BYD, which stands for "Build Your Dreams," has established itself as a pioneer in the global EV market. Each ADS of BYDDF corresponds to 10 shares of BYD Company's Hong Kong-listed stock (01211.HK).

BYDDF stock has gained significant attention due to its strong alignment with global trends toward sustainable energy and electrification. As the automotive industry shifts toward electric vehicles, BYD's innovative technologies and robust product lineup position it as a key player in this transformation. Investors are drawn to BYDDF for its potential to deliver long-term value as the world embraces cleaner energy solutions.

Why BYDDF is a Promising Investment

- Leadership in Electric Vehicle Technology

- Growing Demand for Renewable Energy Solutions

- Strong Market Presence in China and Global Markets

BYD's commitment to innovation and sustainability makes BYDDF stock an attractive option for investors seeking exposure to the EV and renewable energy sectors. With its diverse product offerings, including electric cars, buses, and energy storage systems, BYD is well-positioned to capitalize on the growing demand for green technologies.

Biography of BYD Company

Founded in 1995 by Wang Chuanfu, BYD Company Limited started as a rechargeable battery manufacturer before expanding into the automotive sector. Today, BYD is a global leader in electric vehicles, energy storage, and semiconductor solutions. The company's headquarters is located in Shenzhen, China, and it operates in over 50 countries worldwide.

BYD's journey from a battery manufacturer to a global EV powerhouse reflects its commitment to innovation and sustainability. Under the leadership of Wang Chuanfu, BYD has consistently pushed the boundaries of technology, developing cutting-edge solutions that address the world's energy and transportation challenges.

Data and Biodata of BYD Company

| Category | Details |

|---|---|

| Founding Year | 1995 |

| Founder | Wang Chuanfu |

| Headquarters | Shenzhen, China |

| Primary Products | Electric Vehicles, Batteries, Energy Storage Systems |

| Global Presence | Operates in over 50 countries |

Market Performance and Trends

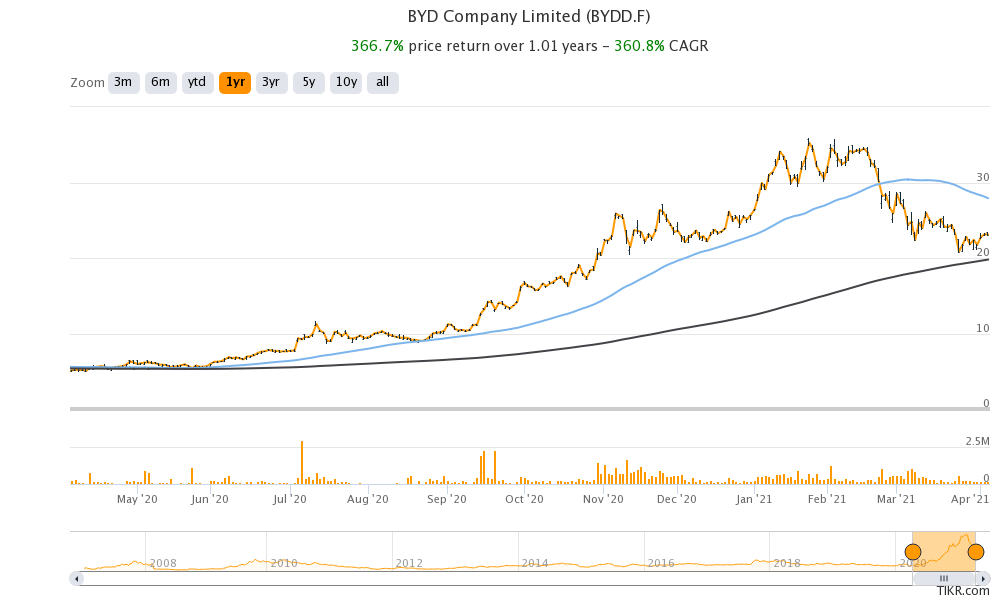

BYDDF stock has experienced significant growth in recent years, driven by the increasing demand for electric vehicles and renewable energy solutions. As of the latest financial reports, BYD's revenue has consistently increased, reflecting its strong market position and expanding customer base.

Read also:Masiela Lusha A Rising Star In The Entertainment Industry

Data from Bloomberg and other financial platforms indicate that BYDDF stock has outperformed many of its peers in the EV sector. This growth can be attributed to BYD's innovative product lineup, including the popular Tang, Han, and Song EV models, as well as its expanding energy storage solutions.

Key Market Trends

- Rising Demand for Electric Vehicles

- Growth in Renewable Energy Adoption

- Expansion into New Markets

According to a report by McKinsey & Company, the global EV market is expected to grow at a compound annual growth rate (CAGR) of 23% from 2022 to 2030. This trend bodes well for BYDDF stock, as BYD continues to expand its operations and product offerings to meet the growing demand for sustainable transportation solutions.

Financial Analysis of BYDDF

BYDDF's financial performance has been robust, with consistent revenue growth and expanding profit margins. The company's quarterly earnings reports highlight its ability to deliver strong financial results despite global economic challenges.

In 2022, BYD reported a 96% increase in revenue compared to the previous year, driven by strong sales of electric vehicles and batteries. This financial success is a testament to BYD's strategic focus on innovation and market expansion. Investors have responded positively to these results, driving up the value of BYDDF stock in the global market.

Key Financial Metrics

- Revenue Growth: 96% YoY

- Profit Margin: 5.5%

- Operating Cash Flow: $7.8 billion

BYD's financial health is further bolstered by its strong balance sheet and low debt levels. These factors contribute to the company's ability to invest in research and development, ensuring its continued leadership in the EV and renewable energy sectors.

Sustainability and Innovation

BYD's commitment to sustainability is at the core of its business strategy. The company has invested heavily in research and development to create innovative solutions that address the world's energy and transportation challenges. BYD's Blade Battery technology, for example, offers enhanced safety and longer lifespan compared to traditional lithium-ion batteries.

BYD's focus on sustainability extends beyond its product offerings to its manufacturing processes and supply chain management. The company has implemented numerous initiatives to reduce its carbon footprint and promote environmental responsibility. This commitment to sustainability aligns with global efforts to combat climate change and transition to cleaner energy sources.

Innovative Technologies

- Blade Battery Technology

- Energy Storage Solutions

- Semiconductor Innovations

BYD's innovative technologies position it as a leader in the EV and renewable energy sectors. By continuously pushing the boundaries of what is possible, BYD ensures its products remain at the forefront of industry advancements.

Risks and Challenges

While BYDDF stock offers significant potential for growth, investors should be aware of the risks and challenges associated with investing in the EV and renewable energy sectors. The global automotive industry is highly competitive, and BYD faces intense competition from established players like Tesla and emerging competitors in China and beyond.

Regulatory changes, supply chain disruptions, and economic uncertainties can also impact BYDDF's performance. Investors must carefully evaluate these risks and consider their investment horizon and risk tolerance before adding BYDDF stock to their portfolio.

Key Risks

- Intense Competition in the EV Market

- Regulatory Changes Affecting the Automotive Industry

- Supply Chain Disruptions

Despite these challenges, BYD's strong market position, innovative technologies, and commitment to sustainability provide a solid foundation for long-term success.

Long-Term Potential

BYDDF stock holds significant long-term potential, driven by the growing demand for electric vehicles and renewable energy solutions. As the world transitions to cleaner energy sources, BYD's leadership in the EV and energy storage sectors positions it as a key player in this transformative industry.

Investors who adopt a long-term perspective are likely to benefit from BYDDF's continued growth and innovation. With its diverse product offerings and expanding global presence, BYD is well-positioned to capitalize on the opportunities presented by the green energy revolution.

Future Growth Drivers

- Expansion into New Markets

- Development of New Technologies

- Partnerships with Global Companies

BYD's strategic focus on innovation and market expansion ensures its continued leadership in the EV and renewable energy sectors, making BYDDF stock an attractive option for long-term investors.

Investment Strategy for BYDDF

Investing in BYDDF stock requires a well-thought-out strategy that considers the company's strengths, risks, and long-term prospects. Investors should conduct thorough research and analysis before making a decision, taking into account factors such as market trends, financial performance, and competitive landscape.

A diversified investment approach that includes BYDDF stock alongside other assets can help mitigate risks and enhance returns. Investors should also stay informed about industry developments and regulatory changes that may impact BYDDF's performance.

Key Considerations

- Market Trends and Growth Opportunities

- Financial Performance and Profitability

- Competitive Landscape and Risks

By adopting a strategic approach to investing in BYDDF stock, investors can position themselves to benefit from the company's continued growth and innovation in the EV and renewable energy sectors.

Comparison with Competitors

BYDDF stock competes with other major players in the EV and renewable energy sectors, including Tesla, NIO, and XPeng. While each company has its own strengths and weaknesses, BYD stands out for its diverse product offerings, innovative technologies, and strong market position in China and beyond.

BYD's leadership in battery technology and energy storage solutions gives it a competitive edge in the global market. The company's Blade Battery technology, for example, offers enhanced safety and longer lifespan compared to traditional lithium-ion batteries, making it a preferred choice for many consumers.

Competitor Comparison

- BYD: Diverse Product Offerings and Strong Market Position

- Tesla: Market Leader in Electric Vehicles

- NIO: Focus on Premium Electric Vehicles

While each company has its own unique strengths, BYD's commitment to innovation and sustainability positions it as a key player in the EV and renewable energy sectors.

Conclusion and Call to Action

BYDDF stock represents a compelling investment opportunity for those looking to capitalize on the growing demand for electric vehicles and renewable energy solutions. With its innovative technologies, strong market position, and commitment to sustainability, BYD is well-positioned to lead the green energy revolution.

This article has provided an in-depth analysis of BYDDF stock, covering its market performance, financial health, and long-term potential. By understanding these factors, investors can make informed decisions about whether BYDDF is the right fit for their portfolio.

We invite you to share your thoughts and insights in the comments section below. Have you invested in BYDDF stock? What are your thoughts on the company's future prospects? Don't forget to explore other articles on our site for more insights into the world of investing and finance.