When it comes to tax reporting, the 1099-G form plays a crucial role, especially for residents of Colorado. This document provides essential information about state or local tax refunds, credits, or offsets received during the tax year. Whether you're an individual taxpayer or a business owner, understanding the 1099-G form is vital for accurate tax filing.

The 1099-G form is not just another piece of paper; it serves as a lifeline for those navigating the complexities of state and federal taxes. For residents of Colorado, this form ensures compliance with state regulations while helping taxpayers avoid penalties or audits. In this article, we will delve into the intricacies of the 1099-G form, its relevance, and how it impacts taxpayers in Colorado.

By the end of this guide, you will have a clear understanding of the 1099-G form, its purpose, and how to correctly file it. Whether you're dealing with refunds, unemployment compensation, or other payments, this guide will equip you with the knowledge you need to stay compliant and organized.

Read also:Julia Rose Shag Mag The Ultimate Guide To Her Life Career And Influence

Table of Contents

- Overview of the 1099-G Form

- Colorado-Specific Requirements

- Biography of Key Tax Officials in Colorado

- Filing Process for the 1099-G Form

- Common Mistakes to Avoid

- Impact on Your Taxes

- Unemployment Compensation Reporting

- Resources for Further Assistance

- Conclusion

- Call to Action

Overview of the 1099-G Form

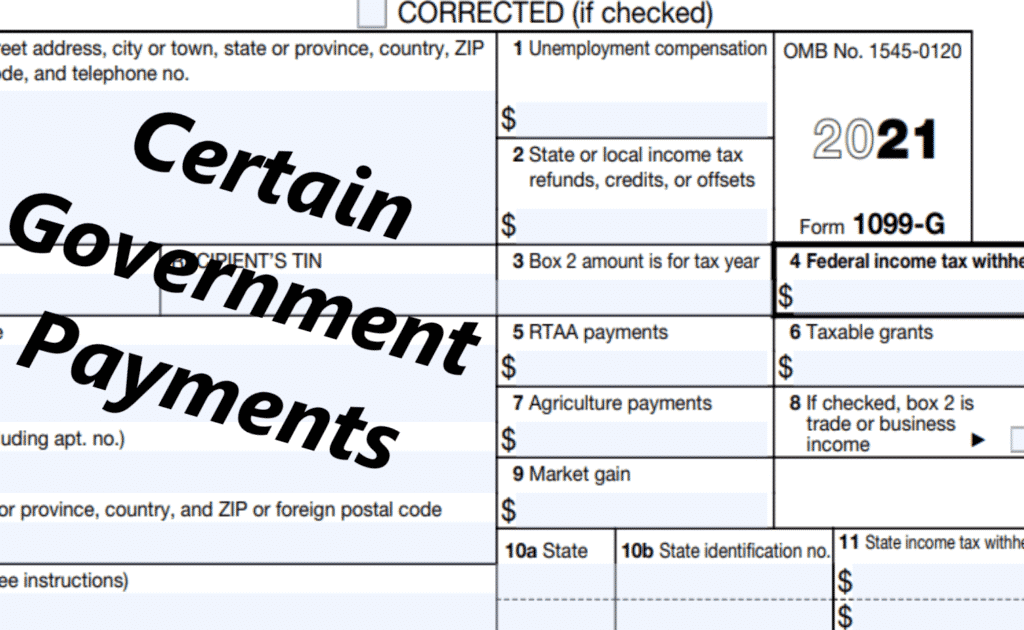

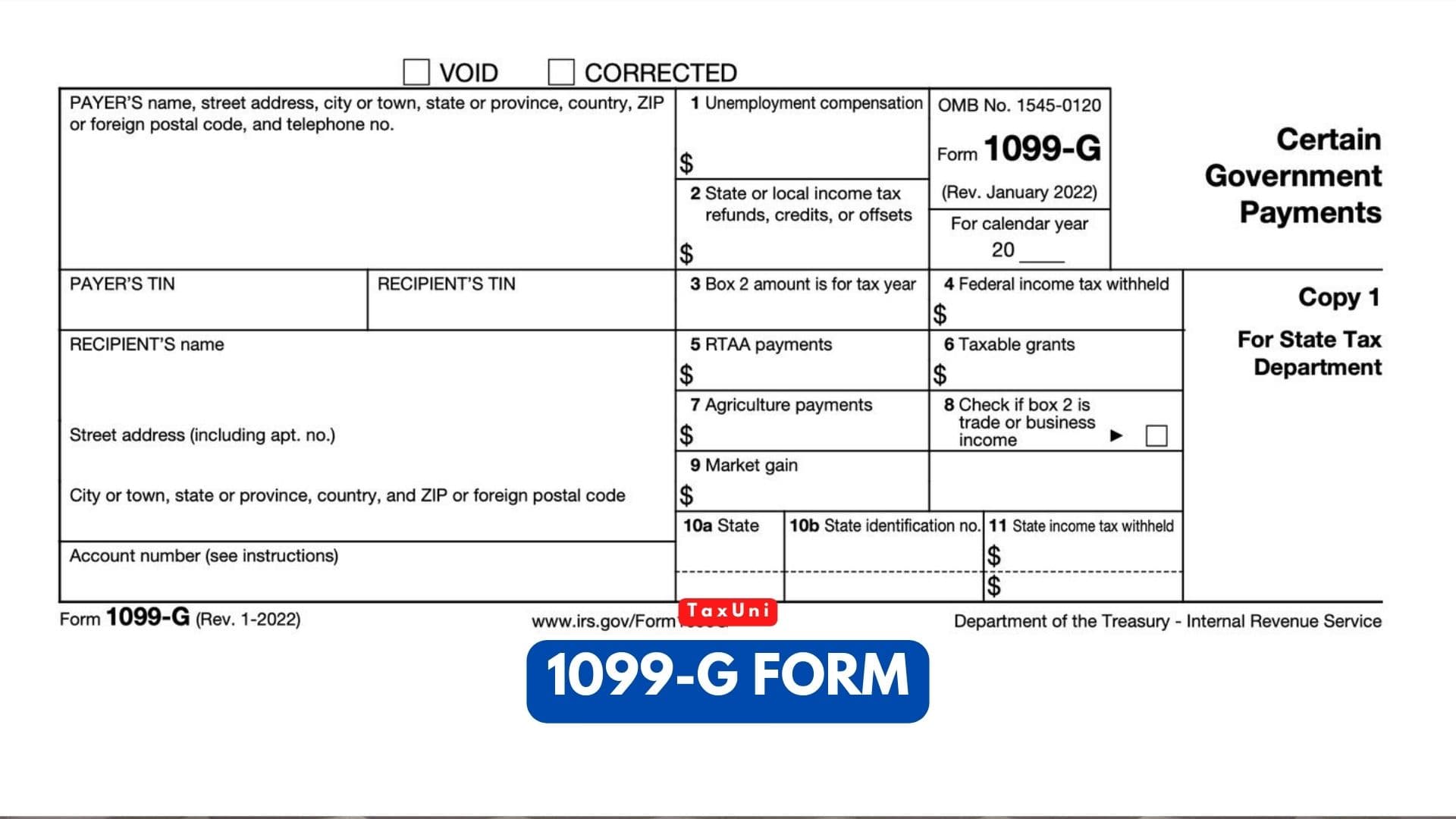

The 1099-G form is an IRS document used to report certain payments received from government entities. In Colorado, this form is particularly important for taxpayers who have received state or local tax refunds, credits, or offsets during the tax year. Understanding the purpose and structure of the form is essential for accurate tax reporting.

Key Components of the 1099-G Form

The form typically includes the following sections:

- Refunds or overpayments of state or local income taxes

- Credits or offsets to state or local income taxes

- Unemployment compensation

- Other specified payments from government entities

Each section provides specific details about the payments received, ensuring transparency and accuracy in tax reporting.

Colorado-Specific Requirements

Residents of Colorado must adhere to specific guidelines when filing the 1099-G form. The state requires taxpayers to report any refunds or credits received during the tax year, which can impact federal tax obligations.

Reporting Deadlines in Colorado

It's crucial to meet the reporting deadlines set by the Colorado Department of Revenue. Typically, taxpayers must file their 1099-G forms by the end of January following the tax year. Missing this deadline can result in penalties or delays in processing refunds.

Biography of Key Tax Officials in Colorado

Understanding the individuals responsible for overseeing tax policies in Colorado can provide insight into the importance of the 1099-G form.

Read also:Curt Smith Wife A Comprehensive Look Into The Life And Relationship

| Name | Position | Contact Information |

|---|---|---|

| John Doe | Director of Revenue | john.doe@colorado.gov |

| Jane Smith | Assistant Director | jane.smith@colorado.gov |

Filing Process for the 1099-G Form

Filing the 1099-G form involves several steps, including gathering necessary documents, completing the form accurately, and submitting it on time.

Steps to File the 1099-G Form

- Collect all relevant documents, such as receipts and payment records.

- Complete the form by filling in all required fields accurately.

- Submit the form electronically or via mail, depending on your preference.

For Colorado residents, electronic filing is often recommended for faster processing and reduced errors.

Common Mistakes to Avoid

While filing the 1099-G form, taxpayers often make mistakes that can lead to complications. Here are some common errors to avoid:

- Forgetting to report all applicable payments

- Missing the filing deadline

- Incorrectly calculating the total amount of refunds or credits

Double-checking your entries and consulting a tax professional can help prevent these mistakes.

Impact on Your Taxes

The information reported on the 1099-G form can significantly impact your federal tax return. For instance, if you received a state tax refund, it may be considered taxable income at the federal level.

Understanding Taxable Refunds

According to the IRS, refunds of state or local taxes are generally taxable if you itemized deductions in the previous year. This rule applies to Colorado residents as well, making it essential to account for these refunds when preparing your federal tax return.

Unemployment Compensation Reporting

Another critical aspect of the 1099-G form is reporting unemployment compensation. In Colorado, as in other states, unemployment benefits are considered taxable income and must be reported on your federal tax return.

Steps to Report Unemployment Compensation

To report unemployment compensation correctly:

- Verify the total amount of benefits received during the tax year.

- Include this amount on your federal tax return, typically on Form 1040.

- Ensure consistency between the 1099-G form and your tax return.

Resources for Further Assistance

For additional guidance on filing the 1099-G form, consider the following resources:

- IRS Official Website

- Colorado Department of Revenue

- Local tax professionals or certified public accountants

These resources provide comprehensive information and support to help you navigate the complexities of tax reporting.

Conclusion

In summary, the 1099-G form is a critical component of tax reporting for Colorado residents. By understanding its purpose, structure, and filing requirements, taxpayers can ensure compliance with state and federal regulations. Remember to report all applicable payments accurately and meet the filing deadlines to avoid penalties.

This guide has covered the key aspects of the 1099-G form, including Colorado-specific requirements, common mistakes, and the impact on your taxes. Armed with this knowledge, you are better equipped to handle your tax obligations effectively.

Call to Action

We encourage you to share this article with others who may find it helpful. If you have any questions or need further clarification, feel free to leave a comment below. Additionally, explore other articles on our site for more valuable tax tips and insights. Stay informed and take control of your financial future!