Are you a Colorado resident who has received a 1099-G form and wondering how it affects your tax refund? Understanding the intricacies of the 1099-G form and its implications for your state tax refund is essential for optimizing your financial situation. This form is issued by government agencies to report certain payments made to individuals, including unemployment compensation, state or local income tax refunds, and other government payments. Navigating this process can seem daunting, but with the right knowledge, you can ensure you're maximizing your return.

In this article, we'll break down everything you need to know about the Colorado 1099-G tax refund. From understanding what the form entails to learning how it impacts your refund, we'll provide actionable insights to help you navigate this process confidently. Whether you're a seasoned taxpayer or new to filing, this guide will equip you with the necessary tools to make informed decisions.

Our focus will be on ensuring you understand the significance of the 1099-G form and how it fits into your overall tax strategy. By the end of this article, you'll have a clear roadmap for handling your tax refund efficiently and effectively. Let's dive in!

Read also:Charlie Sheen Alive Unveiling The Truth Behind The Legend

Table of Contents

- What is a 1099-G Form?

- Colorado Tax Refunds and the 1099-G Form

- How to Report Your 1099-G Information

- Common Mistakes to Avoid

- Unemployment Compensation and the 1099-G

- How Tax Software Can Help

- Federal vs. State Tax Implications

- Important Filing Deadlines

- Frequently Asked Questions

- Conclusion and Next Steps

What is a 1099-G Form?

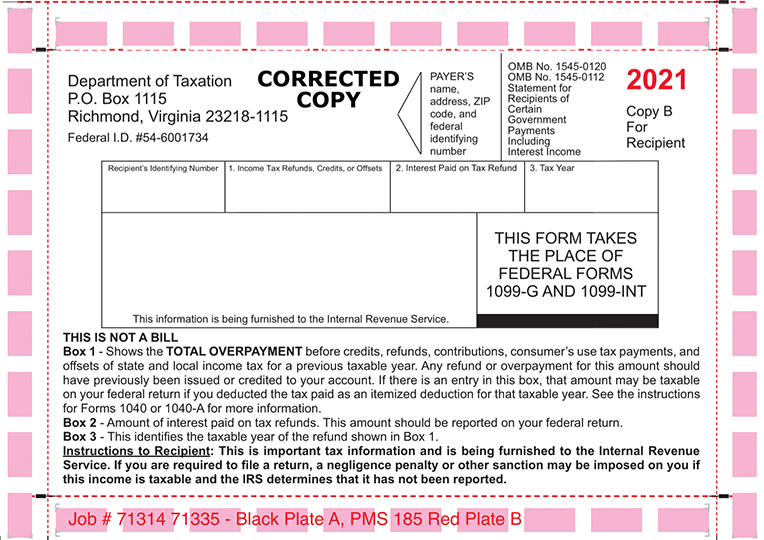

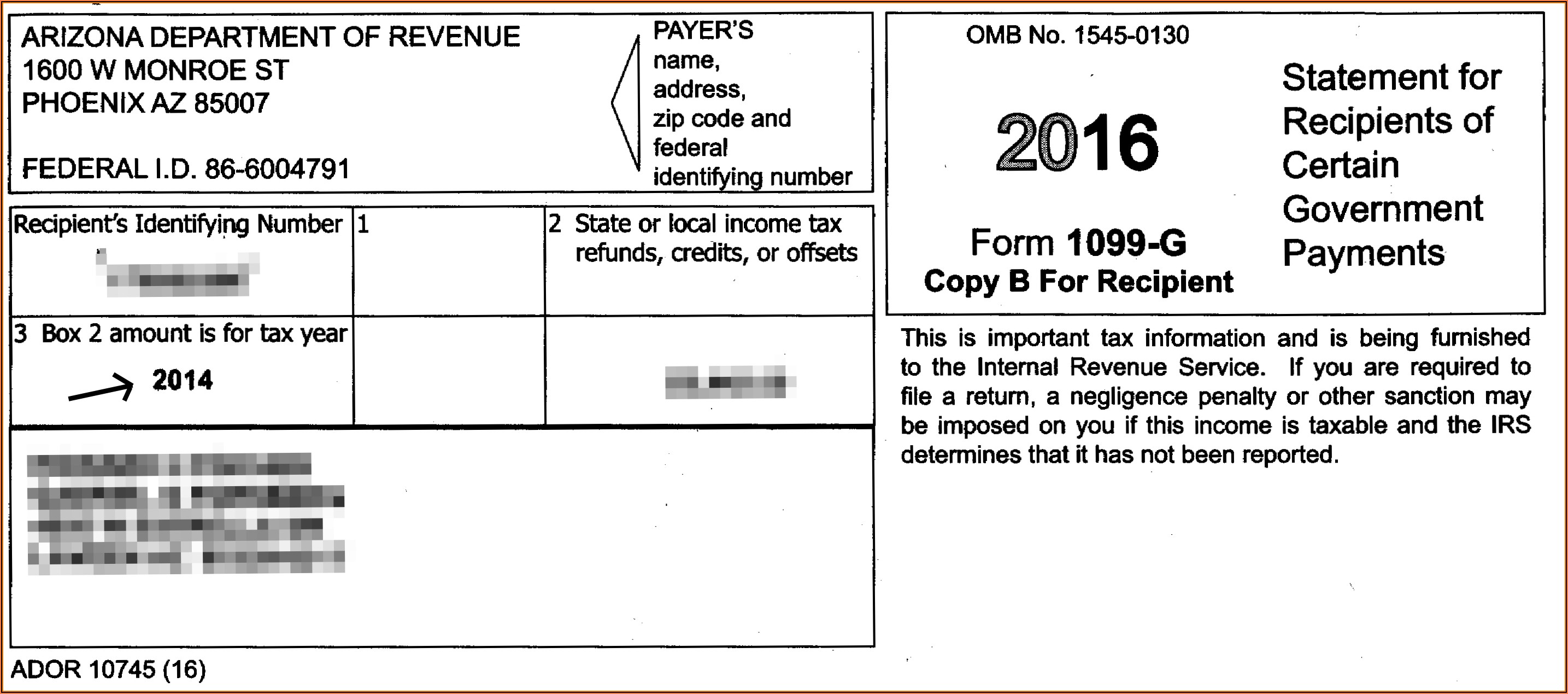

The 1099-G form is an IRS document used to report certain payments received from government entities. These payments may include unemployment compensation, state or local income tax refunds, or other government-related payments. For residents of Colorado, this form plays a crucial role in determining your tax obligations and potential refunds.

When you receive a 1099-G, it indicates that you've received payments that could impact your tax return. It's important to include this information when filing your taxes to ensure accuracy and avoid penalties. Understanding the details of the form is the first step toward managing your finances effectively.

Key Components of the 1099-G Form

The form includes several boxes that report different types of payments:

- Box 1: Indicates any state or local tax refunds, credits, or offsets you received during the tax year.

- Box 3: Reports unemployment compensation payments.

- Box 5: Details any other income received from government entities.

Each box provides specific information that must be accurately reported on your tax return to avoid discrepancies.

Colorado Tax Refunds and the 1099-G Form

In Colorado, the 1099-G form is especially relevant for residents who have received a state tax refund or unemployment benefits. If you received a refund from your previous year's tax filing, it must be reported on your current year's return. This is because the refund is essentially a recovery of overpaid taxes, which could affect your taxable income.

How Refunds Impact Your Taxes

When you receive a state tax refund, it may be considered taxable income at the federal level if you itemized deductions in the previous year. However, Colorado follows its own rules, so it's important to consult the latest guidelines from the Colorado Department of Revenue.

Read also:Is Demond Wilson Still Alive Unveiling The Truth About The Legendary Actor

For instance, if you claimed itemized deductions last year and received a refund this year, part of that refund might need to be added back to your income. This adjustment ensures that the correct amount of tax is paid on the recovered funds.

How to Report Your 1099-G Information

Reporting your 1099-G information correctly is vital to avoid errors and potential audits. Here's a step-by-step guide to help you through the process:

Step 1: Verify Your Information

Before filing, double-check the details on your 1099-G form to ensure accuracy. Mistakes in reporting can lead to significant issues, including delays in processing your refund.

Step 2: Include on Your Tax Return

When preparing your federal and state tax returns, include the relevant information from your 1099-G. For federal returns, this typically involves entering the refund amount on Form 1040, Schedule 1. In Colorado, you'll report it on your state-specific forms.

Step 3: Seek Professional Assistance if Needed

If you're unsure about how to report your 1099-G, consider consulting a tax professional or using tax preparation software. These resources can help ensure compliance and accuracy.

Common Mistakes to Avoid

Misreporting or omitting information from your 1099-G form can lead to costly errors. Here are some common mistakes to watch out for:

- Forgetting to include the refund amount on your federal return if you itemized deductions in the previous year.

- Not reporting unemployment compensation correctly, which could result in underpayment of taxes.

- Ignoring other government payments listed on the form, such as grants or credits.

By staying vigilant and double-checking your entries, you can avoid these pitfalls and ensure a smooth filing process.

Unemployment Compensation and the 1099-G

During times of economic uncertainty, many Colorado residents rely on unemployment compensation to support their families. This benefit is reported on the 1099-G form in Box 3. It's important to note that unemployment compensation is generally considered taxable income at both the federal and state levels.

Tax Implications

When reporting unemployment compensation, you must include it as part of your gross income on your tax return. Depending on your overall income, this could push you into a higher tax bracket or affect other deductions and credits you qualify for.

Some taxpayers choose to have federal and state taxes withheld from their unemployment payments to simplify the filing process. If you didn't opt for withholding, you may need to pay estimated taxes quarterly to avoid penalties.

How Tax Software Can Help

Using tax preparation software can significantly ease the burden of filing your taxes, especially when dealing with complex forms like the 1099-G. These programs often walk you through the process step-by-step, ensuring you don't miss any critical details.

Benefits of Tax Software

- Automated calculations to minimize errors.

- Guidance on reporting various forms, including the 1099-G.

- Access to the latest tax laws and updates specific to Colorado.

Popular options like TurboTax, H&R Block, and TaxSlayer offer user-friendly interfaces and robust features to help streamline your tax preparation.

Federal vs. State Tax Implications

While the 1099-G form primarily impacts your federal tax return, it also plays a role in your Colorado state taxes. Understanding the differences between federal and state requirements is essential for accurate reporting.

State-Specific Considerations

Colorado may have unique rules regarding how refunds and unemployment compensation are treated. For example, certain credits or deductions available at the federal level might not apply at the state level. Always refer to the Colorado Department of Revenue for the most up-to-date guidance.

Important Filing Deadlines

Missing tax filing deadlines can result in penalties and interest charges. Here's a quick overview of the key deadlines for Colorado residents:

- Federal Deadline: Typically April 15th, unless extended.

- Colorado Deadline: Aligns with the federal deadline, but always verify for any extensions.

If you anticipate needing more time to file, you can request an extension using Form 4868 for federal taxes and the appropriate Colorado form for state taxes. However, remember that extensions only grant more time to file, not to pay any taxes owed.

Frequently Asked Questions

Q1: Do I Need to Report My State Tax Refund on My Federal Return?

Yes, if you itemized deductions in the previous year and received a state tax refund, you may need to include part of that refund as income on your federal return.

Q2: What Happens if I Don't Report My 1099-G Information?

Failing to report the information on your 1099-G form can result in discrepancies on your tax return, potentially leading to penalties, interest charges, or an audit.

Q3: Can I File My Taxes Without Receiving My 1099-G Form?

Yes, if you haven't received your 1099-G by the filing deadline, you can estimate the amounts based on your records and file your return. However, be sure to update your return if the actual form differs significantly from your estimates.

Conclusion and Next Steps

Navigating the intricacies of the 1099-G form and its impact on your Colorado tax refund doesn't have to be overwhelming. By understanding the key components of the form, accurately reporting the information, and staying informed about deadlines and requirements, you can ensure a smooth and successful filing process.

We encourage you to take action by reviewing your 1099-G form carefully, consulting tax professionals if needed, and utilizing reliable tax preparation tools. Share this article with others who may find it helpful, and explore more resources on our website for additional guidance on tax-related topics.

Remember, knowledge is power when it comes to managing your finances. Stay informed, stay compliant, and make the most of your Colorado 1099-G tax refund!